Understanding the Current Landscape As of April 2024, the U.S. housing market is undergoing significant…

Economic Turbulence: Why It’s Not a Threat to the Housing Market

A Glimmer of Hope Amidst Recession Fears

Recently there has been a growing concern among many people about the possibility of a looming recession. Understandably, the fear is that a recession could lead to a sharp increase in the unemployment rate, potentially triggering a wave of foreclosures reminiscent of the crisis experienced 15 years ago.

However, according to the latest Economic Forecasting Survey from the Wall Street Journal (WSJ), less than half (48%) of economists now believe a recession will occur within the next year. This marks a significant shift in sentiment and the first time in over a year that the probability has dropped below 50%.

“Economists are turning optimistic on the U.S. economy . . . economists lowered the probability of a recession within the next year, from 54% on average in July to a more optimistic 48%. That is the first time they have put the probability below 50% since the middle of last year.”

The Unemployment Rate: An Indicator Not to Fear

While it is true that more people are expected to lose their jobs in the upcoming year, the question remains: will there be enough job losses to instigate a foreclosure wave potent enough to crash the housing market?

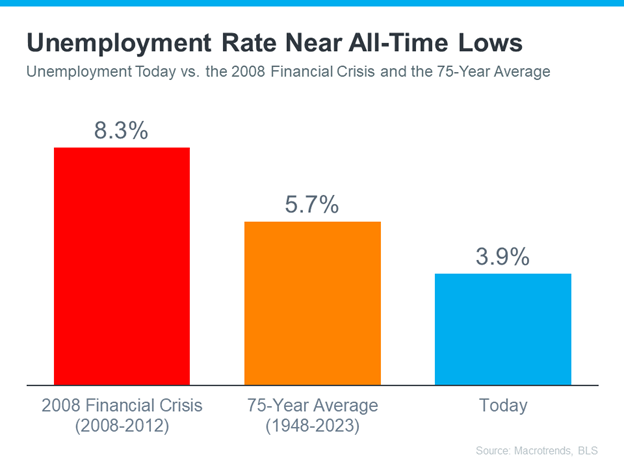

Historical context from Macrotrends and the Bureau of Labor Statistics (BLS) suggests otherwise. Currently, the unemployment rate is near all-time lows. Dating back to 1948, the average unemployment rate is 5.7%. In the aftermath of the 2008 financial crisis, when the housing market crashed, the average unemployment rate was significantly higher at 8.3%. Both these figures tower over today’s unemployment rate.

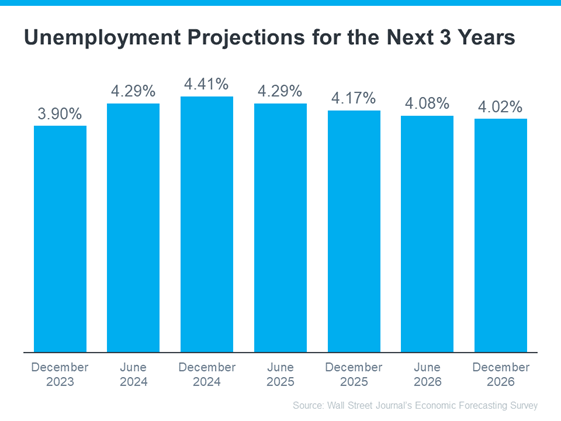

Furthermore, projections indicate that the unemployment rate is likely to remain below the 75-year average. This suggests that the likelihood of a foreclosure wave large enough to severely impact the housing market is low.

Bottom Line: No Need for Panic

Most economists no longer anticipate a recession within the next 12 months. Consequently, they also do not foresee a dramatic rise in the unemployment rate that could lead to a rash of foreclosures and another housing market crash.

While the prospect of increased unemployment is certainly concerning, it’s important to understand its context and implications. In this case, the data suggests that fears of an imminent housing market crash due to job losses are unfounded. If you have further questions about unemployment and its impact on the housing market, don’t hesitate to reach out for a deeper conversation.

About Us

At Innovative Mortgage Brokers, we’re not just another mortgage brokerage firm. We’re a team that is dedicated to providing you with a seamless and rewarding mortgage experience. Our mission is to redefine the way you think about mortgages, combining decades of industry expertise with cutting-edge technology to deliver customized, competitive loan solutions that perfectly meet your needs.

Our process is designed to be quick, straightforward, and cost-effective. We understand that every client is unique, and we take the time to listen to your individual circumstances and aspirations. This personalized approach allows us to offer a wide variety of loan options, each designed to provide maximum value and flexibility.

We’re proud of our commitment to efficiency and transparency, and we make sure our clients are always in the loop. We believe that exceptional customer service is not a luxury, but a necessity. That’s why we always go the extra mile to ensure that your journey towards homeownership is as smooth and stress-free as possible.

Whether you’re a first-time homebuyer, looking to refinance your existing loan, or exploring investment opportunities, trust us to guide you with ease and confidence. With us, you’re not just getting a mortgage – you’re getting a partner dedicated to helping you achieve your homeownership goals.