Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

The 50-Year Mortgage Math No One Mentions

The hidden rate premium that erases most “payment savings”

A 50-year mortgage spreads payments over a longer timeline, which can trim the monthly bill a little. In reality, the rate on a 50-year loan would almost certainly be higher than a 30-year. Once you price in that higher rate, the monthly savings often shrink to a small amount while total interest paid soars. For most buyers and homeowners, there are smarter ways to improve affordability.

Why the buzz now?

Affordability is tight in many markets. Extending the term sounds like an easy fix. Historically, shorter terms price lower than longer terms. A common spread between a 15- and 30-year is about three-quarters of a percent. If a 50-year ever shows up at scale, it would likely price at a premium to the 30-year.

The math in plain English

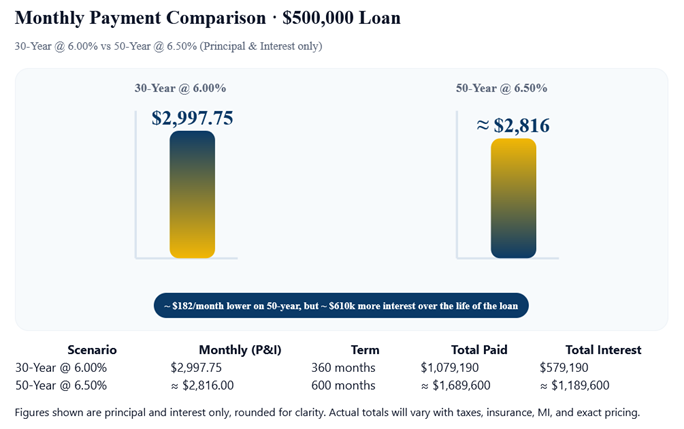

Many comparisons assume the same interest rate for 30- and 50-year loans. That is not realistic. If you assume the 50-year rate is even just 0.50% higher than the 30-year:

- The monthly payment drops only a little, often a few percent.

- The total interest over time explodes because you are paying interest for twenty extra years.

Simple example

Consider a $500,000 loan.

- A typical 30-year payment at a low-6% rate is roughly $3,000 per month (principal and interest).

- A 50-year at a rate about 0.50% higher might lower the payment by only around $180 per month.

- Over the life of the loan, that longer term adds hundreds of thousands of dollars in extra interest.

Numbers vary with market rates and your exact scenario, but the tradeoff is the same: small monthly relief, very large lifetime cost.

Pros

- Slightly lower monthly payment compared with a 30-year at the same loan amount.

- Could help a small group of borrowers qualify on debt-to-income if they are very close to the limit.

- May create flexibility for a short period if cash flow is tight today and you plan a near-term refinance.

Cons

- Likely higher interest rate than a 30-year.

- Much more total interest over time.

- Slower principal reduction and equity build.

- Greater interest-rate risk if you plan to refinance but market rates do not cooperate.

- Possible limited lender participation and stricter guidelines.

Who might consider it?

A 50-year could make sense for a narrow slice of borrowers who:

- Have strong reasons to minimize the payment in the short run and a credible plan to pay down or refinance soon.

- Understand the cost tradeoff and accept it knowingly.

For everyone else, there are better tools to improve affordability.

Smarter ways to lower your payment

- Compare across many lenders. Pricing varies. We shop 30+ lenders for competitive rates and terms.

- Consider a temporary buydown. A 1- or 2-year buydown can meaningfully lower the early payments without adding decades of interest.

- Right-size the term. A 30-year fixed remains the sweet spot for many. If cash flow is stable, a 20- or 15-year can build equity faster and often comes with a lower rate.

- Boost your credit profile. Small improvements in credit score can move pricing tiers.

- Increase your down payment if possible or apply eligible gifts and grants.

- Tackle high-interest debts before applying. Lower DTI can improve eligibility and pricing.

- Refi roadmap. If your situation improves or rates drop, a refinance can reset term and payment without committing to 50 years.

FAQs

Will a 50-year always have a lower payment than a 30-year?

Usually, but not by much once you account for the higher rate that long-term loans typically carry.

Is the savings worth it?

For most borrowers, the small monthly drop does not justify the very large increase in lifetime interest.

Can I pay a 50-year off faster?

Extra principal payments help, but at that point a 30-year with a better rate is often the cleaner starting point.

Bottom line

A 50-year mortgage buys time, not real savings. If you see headlines or ads promising big payment cuts, check the interest rate and run the full cost comparison. Most buyers and homeowners will be better served by optimizing a 30-year or using tools like buydowns and lender shopping.

About Innovative Mortgage Brokers

We help homebuyers and homeowners across Pennsylvania and Florida compare options from 30+ lenders to find the right fit with competitive rates and low fees. If you want a straight answer and help to make the most sense for your budget, we will model the numbers and give you a clear plan. Ready to see your options? Book a quick call.