FHFA Opens Door to Cryptocurrency in Mortgage Risk Assessments: What It Means for Borrowers and…

Fannie Mae is Raising LTV Ratios for 2-4 Unit Primary Residence: Expanding Access to Homeownership in Pennsylvania with Innovative Mortgage Brokers

Fannie Mae, a leading source of financing for mortgage lenders, recently announced significant changes in its Desktop Underwriter (DU) system. The updates are expected to affect the maximum allowable loan-to-value (LTV) ratios for two- to four-unit properties.

Changes to LTV Ratios

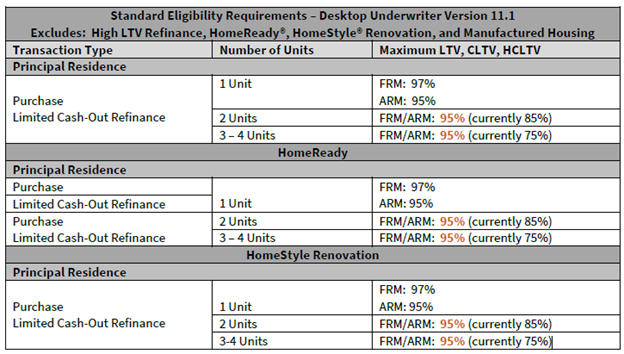

The new updates, set to roll out during the weekend of November 18, will include adjustments to the maximum allowable loan-to-value (LTV) ratios for purchase and limited cash-out transactions on two- to four-unit primary residences. Currently, the maximum allowable LTV on a purchase and limited cash-out refinance for a two-unit property is 85%, and 75% for a three- or four-unit property. These levels are slated to increase to 95%.

However, the update specifies that these changes will not apply to high-balance mortgage loans and manually underwritten loans. Fannie Mae’s maximum LTV ratio for a single-unit home with a fixed-rate mortgage remains unchanged at 97%.

Expanding Access to Credit

Fannie Mae’s decision to increase the Loan-to-Value (LTV) ratios is a strategic move aimed at expanding access to credit and supporting affordable rental housing.

The LTV ratio is an important metric in mortgage lending, as it measures the balance of a loan against the value of the property. It’s a risk assessment tool used by lenders to determine the likelihood of default by the borrower. A higher LTV ratio indicates a higher risk for the lender.

Why is this Change Important

This decision is significant because it broadens the pool of potential borrowers, particularly among those who may struggle to accumulate a large down payment. By increasing the maximum allowable LTV ratio, Fannie Mae is essentially lowering the entry barrier for first-time homebuyers, promoting homeownership, and contributing to economic growth.

Moreover, Fannie Mae’s move also shows its commitment to sustainable and affordable housing. Higher LTV ratios enable more people to access loans for affordable rental housing.

However, it’s worth noting that while increasing LTV ratios can provide more opportunities for homeownership, it also carries certain risks. Higher LTV ratios could lead to increased default rates if borrowers are unable to manage their mortgage payments. Thus, it’s crucial for both borrowers and lenders to carefully consider the implications of these changes.

Exceptions to the Rule

While these changes are significant, they won’t apply to all loan casefiles. High-balance mortgage loans and loans that are manually underwritten will not be subject to the new maximum ratios.

Additionally, certain programs are excluded from these updates. These include the High LTV Refinance, HomeReady®, HomeStyle® Renovation, and Manufactured Housing programs.

Breakdown of New LTV, CLTV, HCLTV Ratios

About Us

Shopping for a mortgage loan can be a complex and time-consuming process. This is where a mortgage broker, becomes extremely valuable.

At Innovative Mortgage Brokers we act as intermediaries between the borrower and the lender. We have extensive knowledge of the market and access to a wide range of loan products from various lenders. This means we can provide you with multiple loan options that cater to your specific financial situation and needs. Rather than you having to do all the legwork, we will compare rates, terms, and fees from different lenders, saving you considerable time and effort.

Moreover, at Innovative Mortgage Brokers we offer personalized advice and guidance throughout the loan application process. We assist with paperwork, negotiate with lenders on your behalf, and help you understand the fine print of your mortgage agreement. By leveraging our expertise and industry connections, we usually secure a better deal than you might get on your own. In essence, partnering with us at Innovative Mortgage Brokers can make the path to homeownership smoother and more efficient. If you are looking for a mortgage in Pennsylvania (PA), give us a chance to show you our competitiveness.

Conclusion

In conclusion, Fannie Mae’s decision to increase LTV ratios for 2-4 unit primary residence properties is a significant move that is set to have far-reaching implications. This strategic adjustment is geared towards expanding access to credit and fostering affordable rental housing, making homeownership more attainable for many. While it does come with certain risks, the careful implementation of these changes could positively impact the housing market and contribute to broader economic growth.

As these changes roll out, partnering with knowledgeable and experienced mortgage brokers like us at Innovative Mortgage Brokers can be incredibly beneficial. We are committed to providing our clients with personalized guidance throughout the loan application process, helping them navigate these updates and secure the best possible deal. If you’re pursuing a mortgage in Pennsylvania, reach out to us – we’re here to make your path to homeownership smoother and more efficient.