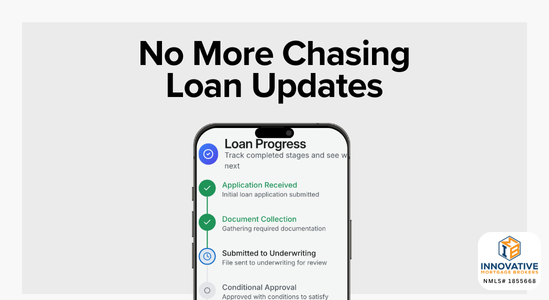

No More Chasing Loan Updates

Our new portal lets you securely check progress, milestones, and next steps anytime you want. If you’ve ever been in the middle of a mortgage transaction, you already know the feeling: you want updates, but you do not want to…