What 90% LTV cashout means, who qualifies, and how to structure it Tapping your equity…

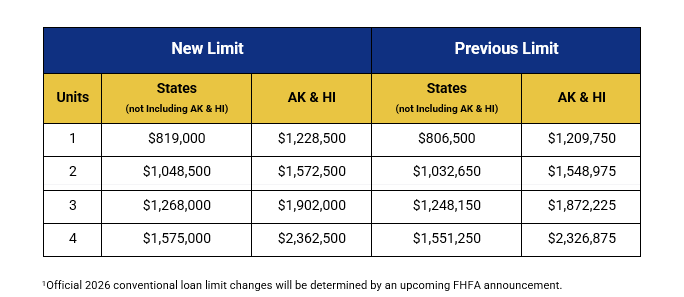

New Conforming Limits for 2026, Available Now

Some Lenders Are Already Honoring Anticipated 2026 Higher Conforming Loan Limits

Each fall, the Federal Housing Finance Agency updates conforming loan limits for Fannie Mae and Freddie Mac. Those limits set the maximum size of a loan that can be sold to the agencies. When limits increase, conforming financing becomes available to more buyers and homeowners. That means broader lender choice, standardized guidelines, and often more competitive rates than many jumbo alternatives.

Here is what matters today. Even before the official effective date, some lenders are already accepting what they anticipate will be the new, higher conforming limits. Names are not important. What matters is access. If you are near the current cap on a purchase or refinance in Pennsylvania or Florida, this can help you move forward sooner and with fewer tradeoffs.

What early acceptance actually means

Early acceptance allows a lender to approve and lock a loan amount above the current limit, as long as that amount is expected to fall within next year’s conforming ceiling. Everything else stays the same. Income, credit, assets, appraisal, and property rules still apply. You are simply able to use a larger conforming loan amount now, rather than waiting for the calendar to turn.

This is not a universal policy. Each lender chooses when and how to implement it. As brokers, we track those updates daily and match your scenario to lenders that are already on board.

Why this helps buyers and homeowners

- More paths to approval – Conforming programs are widely available, which can expand your options and create healthier pricing competition.

- Standardized rules – Agency guidelines are familiar and consistent. That reduces friction compared with many jumbo programs that vary by investor.

- Budget flexibility – If you were planning to increase your down payment just to stay under the old limit, you may not need to. Early acceptance can help you preserve cash to close.

- Cleaner processing – Conforming appraisal standards and documentation are uniform. Fewer moving parts often means fewer last-minute surprises.

Scenarios where early acceptance shines

- First-time buyers who were just above today’s limit. You may be able to keep your preferred price point and remain conforming without stretching your down payment.

- Move-up buyers in Bucks and Montgomery Counties and in popular Florida markets. Higher price ranges can stay conforming, which may improve rate and fee options.

- Refinancers whose balance sits slightly above the current cap. A conforming rate-and-term refinance may be possible instead of a jumbo refi, subject to equity and credit requirements.

- 2 to 4 unit buyers who plan to house hack or invest. Conforming limits vary by unit count. A higher ceiling can make these properties pencil out more easily.

A simple example

Say the current conforming limit is X and your target loan amount is X plus a small bump. Last month you either had to put more money down to stay at X or consider a jumbo loan. With a lender accepting the anticipated limit today, you can keep your loan conforming at X plus that bump, provided you meet standard guidelines. Your payment, cash to close, and total cost are now driven by familiar conforming rules rather than jumbo overlays.

Practical details to keep in mind

Early acceptance is helpful, but it comes with normal fine print.

- The official number still rules – Lenders are making an informed projection. If the final FHFA limit lands lower than expected, we may need to adjust your loan amount or down payment. We build a backup plan in case that happens.

- Rate locks and timing –Ask whether your lock is contingent on the official announcement and how long the lock lasts. Understand extension costs if your closing date shifts.

- Investor overlays – Even within conforming rules, lenders can set their own minimum credit scores, reserve requirements, or property restrictions. We navigate those differences for you.

- County and property tables- Most Pennsylvania and Florida counties follow the baseline limit. High-cost areas and multi-unit properties have different caps. We will place your scenario in the correct category.

- Documentation quality – Clear income, asset, and appraisal documentation keeps the file moving. Early acceptance does not reduce what is needed for a clean approval.

What this means in PA and FL right now

In Bucks, Montgomery, and across the Philadelphia region, price points have nudged higher over the last few years. The same is true across many Florida markets. When lenders begin honoring anticipated higher limits, buyers gain room to make strong offers without stepping into jumbo. Homeowners gain a straightforward path to refinance that uses familiar agency rules. The takeaway is simple. If your loan amount is near the current cap, you may not need to wait to act.

Next steps

- Share your target purchase price or current loan balance.

- We will run both current-limit and anticipated-limit scenarios.

- You receive a concise summary laying out payment, cash to close, and total cost.

- If early acceptance fits, we match you with a lender already honoring the anticipated limit and keep everything conforming.

We are licensed throughout Pennsylvania and Florida and work with many lenders, which gives you more options and competitive rates. If your loan size sits close to today’s limit, now is the time to check your numbers. Early acceptance may keep your financing simple, your options wide, and your timeline on track.