What The New 2026 Conforming Limits Mean for Homebuyers and Homeowners in PA and FL…

Freddie Mac Expands Financing for Multi-Unit Homes

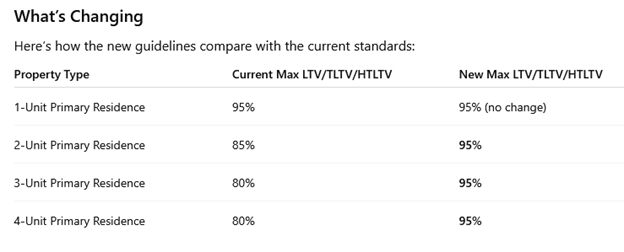

Freddie Mac now allows up to 95% LTV on 2- to 4-unit primary residences.

Effective for mortgages with settlement dates on or after September 29, 2025, Freddie Mac has updated its guidelines to expand financing opportunities for multi-unit primary residences.

The Update at a Glance

Freddie Mac is increasing the maximum Loan-to-Value (LTV), Total LTV (TLTV), and HELOC TLTV (HTLTV) ratios to 95% for Accept Mortgages that are:

- Purchases or

- No cash-out refinances

secured by 2- to 4-unit primary residences.

It’s important to note:

- This change applies only to Accept Mortgages (those that receive an “Accept” recommendation through Freddie Mac’s automated underwriting system).

- Manually underwritten mortgages and super conforming mortgages are excluded from this update.

Why This Matters

This is a significant policy shift that opens doors for more borrowers:

- Lower down payments for multi-unit homes: Instead of needing 15–20% down, qualified buyers can now purchase a duplex, triplex, or fourplex with as little as 5% down.

- Easier access to house hacking: Buyers who plan to live in one unit and rent out the others will have more flexibility to get started with smaller upfront funds.

- Refinance opportunities: Current multi-unit homeowners may have new options to refinance without bringing in as much equity.

Who Benefits Most

- First-time buyers who want to offset their mortgage by renting out additional units.

- Families looking for multi-generational living

- Homeowners with existing 2- to 4-unit properties interested in refinancing without a large equity requirement.

At Innovative Mortgage Brokers, we provide homebuyers and homeowners across Pennsylvania and Florida with a simpler, more affordable way to finance their properties. With access to over 30 lending partners, we’re able to offer highly competitive rates, flexible loan options, and personalized guidance that big banks often can’t match. Whether you’re purchasing your first home, refinancing, or investing in multi-unit housing, our team is here to make the process faster, easier, and tailored to your needs.

Final Takeaway

Freddie Mac’s decision to bring 2- to 4-unit primary residences up to the same 95% financing level as single-unit homes could be a game changer for buyers and homeowners in markets where multi-unit housing is a practical path to affordability.

If you’re considering purchasing or refinancing a multi-unit property in Pennsylvania or Florida, this update could make the numbers work in your favor.