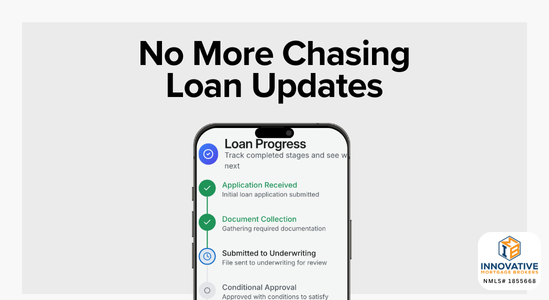

Our new portal lets you securely check progress, milestones, and next steps anytime you want…

Using Per Diem or Stipends as Income on a Mortgage Application

How Mortgage Lenders Treat Stipends and Per Diem Pay

For professionals in fields like healthcare, transportation, or consulting, per diem or stipend income can make up a significant portion of their total earnings. When it comes to mortgage qualification, these income types are treated cautiously, and are only considered when they meet clear documentation and stability standards.

What Is Per Diem and Stipend Income?

Per diem income is typically a daily allowance paid to cover job-related expenses like meals, lodging, or travel. Stipends are fixed regular payments given for specific work roles, often as part of temporary assignments or contract work. While these payments may be consistent, they are not always considered income for mortgage purposes.

General Treatment Across Loan Programs

Lenders view per diem and stipend income as reimbursements, not wages. As such, these payments are generally not included in qualifying income unless they are taxable and clearly shown to be regular and ongoing.

Documentation Requirements

To potentially include per diem or stipend income, borrowers must provide:

- Pay stubs showing year-to-date earnings that clearly include per diem or stipend payments

- W-2s and/or tax returns showing these amounts as taxable income

- A letter from the employer confirming the nature, frequency, and likelihood of continuance

The income must be clearly distinguishable as compensation rather than reimbursement.

Taxable vs. Nontaxable Treatment

Only taxable per diem or stipend income may be considered for mortgage qualification. If these payments are non-taxable (i.e., considered reimbursements), they are excluded from income calculations.

Lenders will often cross-reference tax documents to verify whether per diem amounts were included in gross income. If not, they’re treated as expense reimbursements and disallowed.

Stability and Continuity

A two-year history of receiving taxable per diem or stipend income is usually required. Additionally, the employer must confirm the income is expected to continue for at least three more years.

Without strong evidence of continuity and documentation that the income is taxable, most underwriters will not include per diem or stipend income in qualification.

Loan Program Specifics

- Conventional Loans: Very restrictive; generally exclude non-taxable reimbursements. May consider taxable per diem with strong documentation.

- FHA Loans: Typically do not allow per diem or stipend income unless it is regular, taxable, and part of base compensation.

- VA Loans: Rarely include per diem or stipend income unless it is clearly documented and taxable.

Bottom Line

Per diem and stipend income can only be used to qualify for a mortgage if it is taxable, consistent, and expected to continue. Because these payments are usually seen as reimbursements, they must be well-documented and verified as true income to be included in qualification calculations.