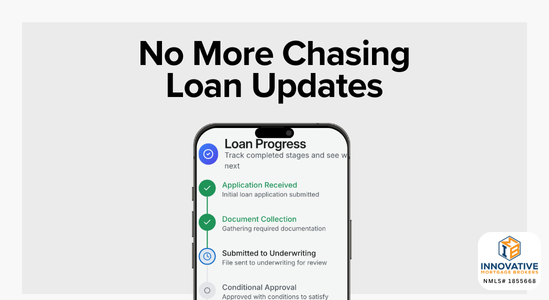

Our new portal lets you securely check progress, milestones, and next steps anytime you want…

Who Really Sets the Mortgage Rules

Conventional follows Fannie Mae and Freddie Mac, FHA follows HUD, Non-QM is lender specific

Not all mortgages follow the same playbook. Conventional loans largely follow standards set by Fannie Mae and Freddie Mac. FHA loans follow rules from HUD. Non‑QM loans do not tie to an agency rulebook, so each lender sets its own guidelines. Knowing who writes the rules helps you predict documentation, approval paths, and how flexible a lender can be.

Quick Take

- Conventional: Rules come from Fannie Mae and Freddie Mac. Easier to research, consistent, and widely accepted.

- FHA: Rules come from HUD’s handbook. More credit flexibility with set requirements for property and mortgage insurance.

- Non‑QM: Rules vary by lender. Great for unique income or credit, but guidelines and pricing are not uniform.

Who Writes the Rules

|

Loan Type |

Rule Maker |

Where the Rules Live |

How Lenders Use Them |

| Conventional (Conforming) | Fannie Mae and Freddie Mac | Fannie Mae Selling Guide; Freddie Mac Seller/Servicer Guide | Lenders follow the guides and run automated underwriting (DU for Fannie Mae, LPA for Freddie Mac) |

| FHA | HUD | FHA Single Family Housing Policy Handbook (4000.1) | Lenders follow the handbook and FHA case‑binders; property must meet FHA standards |

| Non‑QM | Individual lenders and investors | Proprietary program matrices and credit guides | Lenders set their own rules and appetite for risk; documentation and terms differ by lender |

Why Conventional Often Feels Simpler

- Single source of truth: Two agencies, two public guides. Most lenders align to these standards.

- Automated decisions: DU or LPA findings tell you what documentation is required and whether the file fits.

- Predictable overlays: Some lenders add minor overlays, but the core rules are consistent across the industry.

Non‑QM: Case‑by‑Case Rules

Non‑QM programs help when traditional documentation does not fit. The tradeoff is that each lender sets its own playbook.

Common Non‑QM Programs

- Bank statement loans for self‑employed income

- DSCR loans for investment properties based on rental cash flow

- Asset utilization or asset depletion programs

- P&L‑only or alternative income documentation options

What varies by lender

- Minimum credit scores and reserves

- Allowed LTVs and cash‑out limits

- How income is calculated from statements or P&L

- Pricing adjustments for occupancy, property type, or credit depth

- Seasoning requirements (these can meaningfully change eligibility and timing):

- Funds to close seasoning: how long your down payment and reserves must sit in the account (often 30–60 days) and rules for large deposits

- Time on title for cash out: months you must own the property before cash out is allowed and how value is measured during early ownership

- Mortgage/rent history: number of on time payments required and whether alternative verification is acceptable

- Gift funds: when gifts must be deposited and documented, and whether donor accounts must be seasoned

- Business operating history (self employed): how long the business must be established for bank statement or P&L programs

Because rules differ, two lenders can reach different decisions on the same borrower. Shopping matters.

How to Choose the Right Lane

- Start with Conventional and FHA – If you fit either agency box, you usually get clearer rules and broader investor acceptance.

- Use Non‑QM when documentation is the blocker – Self‑employed with complex income, new investors, or unique situations can benefit from a tailored program.

Scenario playbook (what usually wins with Non-QM and why)

- Self‑employed buyer with large write‑offs

Often wins: Non‑QM bank statement or P&L program.

Why: Qualifies cash‑flow when tax returns are lean. - Investor purchase or refinance

Often wins: Non‑QM DSCR.

Why: Uses property cash flow; personal DTI is less central.

FAQs

Are Conventional rules identical across lenders? Core rules match the Fannie Mae and Freddie Mac guides. Lenders can add overlays, but major differences are rare.

Can FHA be denied by one lender and approved by another? It can happen if overlays differ or one lender handles a manual downgrade more conservatively.

Why are Non‑QM quotes so different? Each lender sets risk appetite, documentation, and pricing. Two term sheets can look very different for the same borrower.

Can I switch from Non‑QM to Conventional later? Yes. Many borrowers refinance into an agency loan after building history or equity.

Our approach in Pennsylvania and Florida

We start with the clearest, most cost‑effective path your file qualifies for. If the box is tight, we price agency and Non‑QM options side by side across 30+ lenders and explain the tradeoffs in plain English. You get competitive rates, transparent costs, and a loan built around your goals.

Ready to compare options? We will map your numbers, and show you a clean path to closing.