Sellers must price smart; buyers gain leverage Inventory finally caught up with demand in September,…

FHA or Conventional: Which Mortgage Is Better

Make the Right Choice by Focusing on Monthly Cost

When you start exploring mortgages, two of the most common options are FHA loans and conventional loans. Both can get you into a home, but the better choice depends on your credit profile, down payment, and long-term goals. The smartest approach is to look beyond the program’s name and focus on what matters most, your monthly cost and overall financial fit.

What Is an FHA Loan?

An FHA loan is insured by the Federal Housing Administration. The government doesn’t lend directly, but by backing the loan, lenders are more comfortable approving borrowers who may not meet stricter requirements.

Key highlights of FHA loans:

- Low down payment:5% with a credit score of 580 or higher.

- Credit flexibility: You can qualify with a FICO as low as 500 if you put at least 10% down. For scores between 500–579, the 10%+ down payment is required.

- Higher debt tolerance: Lenders may allow debt-to-income ratios up to 57% in certain cases.

- Mortgage insurance: Requires both upfront and ongoing mortgage insurance premiums (MIP), which generally stay in place for the life of the loan unless you refinance.

These loans are often a fit for first-time buyers or anyone with limited savings or lower credit scores.

What Is a Conventional Loan?

Conventional loans are offered by private lenders and often purchased by Fannie Mae or Freddie Mac. Since they’re not government-backed, they come with stricter qualification standards, but also more long-term flexibility.

Key highlights of conventional loans:

- Down payment: As low as 3% for first time buyers.

- Credit standards: 620 is the baseline, but you’ll usually need a higher score, around 720+ to secure competitive rates.

- Private mortgage insurance (PMI): Required if you put less than 20% down, but unlike FHA loans, PMI can be removed once you reach 20% equity.

- Loan variety: Includes fixed-rate, adjustable-rate, and jumbo options.

Conventional loans tend to reward stronger credit and larger down payments with better rates and fewer long-term costs.

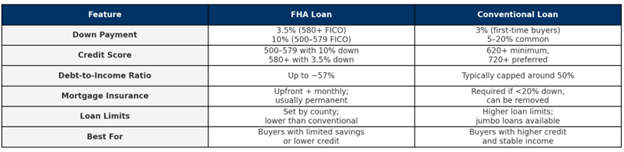

FHA vs. Conventional: Side-by-Side

Which Is Better?

It depends on your financial situation. For buyers with credit scores below about 720, FHA often provides the better deal since its rates can be more forgiving, even with the cost of mortgage insurance. For those with 720+ FICO scores, conventional loans usually win out because they offer lower rates and the ability to drop PMI over time.

But here’s the key: don’t pick a loan based on the program’s name. What matters is the monthly cost and how it fits your budget. For some, an FHA loan will mean a lower payment today. For others, conventional will save money over the long run.

Costs Over Time

- FHA loans: Easier entry with smaller down payments and looser credit standards. The tradeoff is ongoing mortgage insurance, which adds to monthly costs and stays in place unless you refinance.

- Conventional loans: May require stronger credit and more upfront, but PMI eventually goes away, saving thousands if you stay in the home long term.

If you only plan to keep the loan for a handful of years, the difference may not matter much. But if you’re staying put for a decade or more, those insurance costs add up.

Who Should Consider FHA?

- Buyers with scores under 620, or even as low as 500 if they have 10% down.

- Households with higher debt-to-income ratios.

- First-time homebuyers with limited cash savings.

- Anyone who wants to buy now and refinance later once their profile improves.

Who Should Consider Conventional?

- Borrowers with scores above 680, especially 720+.

- Buyers who can put down 3+%.

- Those who want PMI that eventually drops off.

- Buyers eyeing higher-priced homes, second homes, or investment properties.

Property Types Allowed

Another key difference between FHA and conventional loans is property eligibility. FHA loans are only available for primary residences; you must live in the home as your main address. Conventional loans, on the other hand, can be used for primary homes, second homes, and even investment properties. This added flexibility makes conventional financing the go-to choice for buyers looking to build wealth through rental properties or purchase a vacation home.

Flexibility to Refinance Later

It’s also worth remembering that your first loan doesn’t have to be your forever loan. Borrowers can always start with one program, FHA or conventional, and refinance later into another if their credit score, income, or equity improves. For example, you might use an FHA loan today to qualify with a smaller down payment or lower score, then refinance into a conventional loan down the road to remove mortgage insurance and lower monthly costs. This flexibility makes homeownership more accessible without locking you into one path long-term.

Final Thoughts

FHA and conventional loans each serve a purpose. FHA opens doors for borrowers who need flexibility with credit and income, while conventional loans reward stronger profiles with lower long-term costs. Instead of asking which loan is “better,” the smarter question is: which loan gives me the most affordable monthly payment and aligns with my goals?

At Innovative Mortgage Brokers, we run the numbers on both FHA and conventional loans for every client. With access to over 30 lenders, we compare options side by side so you see exactly what works best for your situation.

Thinking about buying or refinancing in PA or FL? Let’s look at the numbers together so you can make the choice that gives you the confidence and payment, you need.