Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

Refinancing Just Got Cheaper in Pennsylvania & Florida

Save on closing costs and keep more money in your pocket without waiting for rates to drop.

When you’re refinancing or buying a home, the last thing you want is a complicated and expensive closing process. That’s where programs like TRAC Lite, TRAC, and TRAC+ come in, they’re designed to make things easier, faster, and in most cases, less expensive.

The newest option, TRAC Lite, is now available in Pennsylvania and Florida. If you’re thinking about refinancing, this could be a smart way to save money on closing costs while still enjoying a smooth, reliable process.

Why Closing Costs Matter

Closing costs typically range between 2% and 5% of the loan amount. On a $300,000 mortgage, that could mean anywhere from $6,000 to $15,000 in additional fees. Even if you’ve locked in a competitive mortgage rate, ignoring these costs can put a strain on your budget.

What many people don’t realize is that title fees and settlement charges often make up a big chunk of those expenses. TRAC programs are aimed directly at this problem, by streamlining the process, they keep more money in your pocket

Spotlight on TRAC Lite (Now in PA & FL)

TRAC Lite is the newest option, now available to homeowners in Pennsylvania and Florida. It’s designed specifically for refinance loans, making it a great fit if you’re looking to restructure your mortgage, lower payments, or tap into equity.

Key benefits include:

- No lender title fee – One of the most common and often misunderstood charges is eliminated.

- Capped settlement costs – Fees are fixed between $375–$600, depending on your state.

- One trusted provider – Instead of coordinating with multiple offices, everything is handled through a single settlement partner.

- Flexibility in closing – Choose from in-person, hybrid, or fully remote.

For a homeowner, this translates into predictable, lower costs and less hassle.

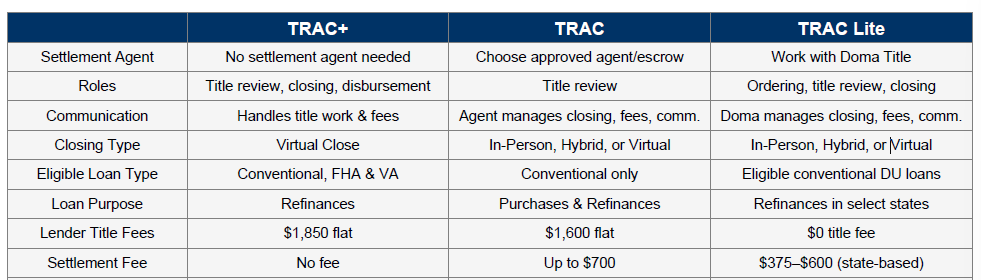

Comparing TRAC Lite, TRAC, and TRAC+

While TRAC Lite is the most cost-conscious choice, the other programs also serve important needs.

Here’s a simple breakdown:

Why This Is Good Timing

Instead of waiting around for rates to shift, you can take advantage of programs that make refinancing simpler and more affordable. TRAC Lite reduces upfront costs, so you can move quickly, lower your monthly expenses, and put your money to better use right away.

The Bottom Line

These programs aren’t just about making things easier for lenders — they’re about giving homeowners and buyers more control, more transparency, and more savings.

If you’re in Pennsylvania or Florida and considering a refinance, TRAC Lite may be one of the most cost-effective ways to move forward right now.